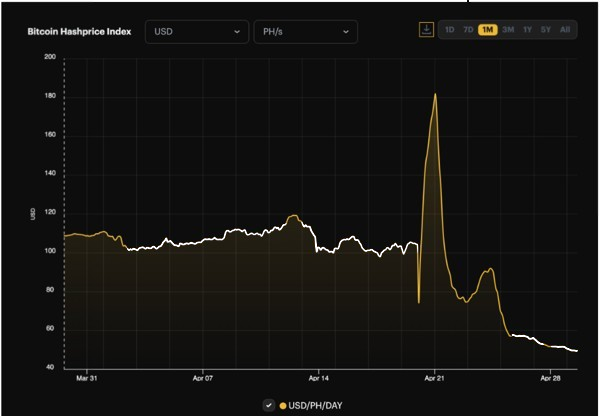

A key indicator of Bitcoin mining activity is the “hash price.” The extraordinary decline in this number that has occurred recently worries the mining community.

The most recent halving event is the reason why Bitcoin’s hash rate is falling off significantly.

Bitcoin Mining Dilemma

On April 20, Bitcoin initiated its fourth halving, raising hopes for possible gains in Bitcoin mining income. These expectations were not fulfilled, though, as the hash price fell to less than $50 per PH/s on a daily basis.

The idea of hash price was created by Luxor, a business that offers Bitcoin mining services, and it aids in understanding the expected daily revenues in dollars for a mining unit.

The recent halving of Bitcoin, which decreased mining rewards from 6.25 BTC to 3.125 BTC per block, has put pressure on important profitability measures even though the hash rate of the cryptocurrency is still high.

This reduction in prospective revenue comes at a time when the value of the bitcoin market as a whole is fluctuating.

indicator of Bitcoin mining activity

Although not unique, the hash price fall is consistent with other declining BTC measures. TradingView reports that a decline in Bitcoin’s dominance index corresponds to a decline in the cryptocurrency’s total market capitalization.

Only on Wild.io, new players can receive incentives of up to 570%, including 12 BTC + 300 free spins and a daily bonus of 1 BTC. Play right now!

With its market value also trending downward, Bitcoin’s dominance has decreased from over 57.10% in the middle of the month to about 54.69% today. There was an almost 4.4% drop in cryptocurrencies last week.

Even with this negative trend, some observers think the cryptocurrency market is about to show signs of acceleration. They cite metrics such as the Adjusted Spent Output Profit Ratio (aSOPR), which indicates bullish trends in spite of the hazy state of the market at the moment.

Experts with a longer-term viewpoint, such as Rekt Capital, have also weighed in, speculating that Bitcoin would experience a sizable rebound during this half cycle, similar to past cycles.

According to historical statistics, the market value of Bitcoin often peaks 500–550 days after the halving. Bitcoin may be in line for large gains starting in mid-2025 if these trends hold true, highlighting the cyclical nature of this vibrant digital asset market.

Overall, a more nuanced story is suggested by the confluence of basic caution and resilience, even though the immediate consequences of the halving on hash price and market dynamics paint a dire picture.